If You Rebuild It, They Will Come (6 min read)

By: Luke Noble

With 2024 in full swing, the entire real estate sector waits patiently for long rumored federal interest rate cuts to stir the housing pot. In the meantime, there is bubbling turmoil within the Commercial Real Estate sector. As the reader likely knows, commercial office leasing demands have evolved greatly these past several years and the fallout from the relatively recent COVID-19 pandemic really brought things to a head.

With 2024 in full swing, the entire real estate sector waits patiently for long rumored federal interest rate cuts to stir the housing pot. In the meantime, there is bubbling turmoil within the Commercial Real Estate sector. As the reader likely knows, commercial office leasing demands have evolved greatly these past several years and the fallout from the relatively recent COVID-19 pandemic really brought things to a head.

Businesses coast-to-coast continue reevaluating their office footprint needs. Almost every business in the country recently received a crash course in remote work and more than a few realized that not only was remote work possible, but many employees preferred it. This threw a wrench in the gears of the well-established office sector and the beating hearts of commercial downtowns near and far. There will, of course, always be businesses that not only require, but prefer to maintain a mostly in-office team model and keep the hearth fires burning in the city centers. But it is undeniable that many companies are increasingly looking at transitioning permanently to hybrid models or even remote only set ups.

The proliferation of Hybrid and Remote work cultures do alter the value structures that have stood for decades surrounding downtown commercial real estate. With the traditional values of said properties now coming into serious question, ripples are being felt across banking sectors and local tax bases alike. This disturbance has the potential of creating untold havoc and we will save that topic for a different day. However, there is an often-mentioned potential savior (at least in part) to such a predicament by converting a significant chunk of these properties from commercial offices to residential.

In fact, it just so happens that at the exact same time at which commercial office real estate is seeing upheaval, the nation also finds itself in a nationwide residential housing shortage. Tis true that the construction process and ramifications of such conversions can be complex and are not as simple as some would have it seem. However, these conversions could ultimately help kill two birds with one stone by helping to stabilize commercial office leasing while easing a modicum of residential housing pressures.

Outside the Building

Let’s take a high-level look at the conversion process starting from the outside of the building: First, Location, location, location, almost always the most important aspect of real estate, right? However, the factors that might make prime commercial real estate locations…prime…do not always go hand in hand with residential housing needs, but there is certainly some overlap.

According to an October 2023 White House study on the subject, an estimated “15 percent of commercial district office buildings in the 105 largest U.S. cities are suitable for residential conversion.” So, although the center of dense commercial districts might not be the ideal spots, there are regions where residential may make more sense. Furthermore, conversion to mixed-use properties can help facilitate the change. Mixed-use properties combine residential housing with stores, restaurants, and entertainment, thereby adding to the appeal of the area.

As we continue looking at exterior considerations, another major challenge is parking. Many commercial office buildings have their own garages or lots which can just as easily be used by residential, but many others do not. The idea of parking a few blocks away and walking to work is one thing, but doing so with an armload of groceries or a toddler in tow is yet another. Residential properties with no guaranteed parking for their occupants can sink a conversion pretty fast, or at least lower the value of such a space.

Windows can be another sticking point when it comes to conversions. Offices are typically built with wide open spaces where natural light can shine through into the interior. Thus, as soon as you start dividing up that space with walls for apartments, some areas deep in the interior can end up devoid of any natural light. This is highly dependent on the size of the given space and thus adds to the filtering process between which buildings are viable and which are not. Commercial buildings that incorporate central courtyards or buildings of odd shapes like the block letter “O” letter “U” or “L” can be better candidates as they allow natural light to delve deeper into the inner recesses. Often, older buildings lend themselves better to conversion with windows that can be opened given a more segmented classic layout.

Deeper Inside the Building

Let us head inside and see what other changes need to be considered. For one, the differences in plumbing between a commercial use building and a residential can result in incredibly expensive conversion costs. Commercial buildings tend to have centralized mass-use restrooms often for an entire floor, good luck trying to get an entire floor of residential occupants to share a bathroom. This reminds us of our college dorm days…also a story for a different blog and you can wear your flip flops for that one!

Back to it, the plumbing for each floor will need to be divided and rerun accordingly. Often, offices will have light kitchen facilities and drinking fountains so perhaps some water will be available to build out residential kitchens/water closets, but chances are there will need to be massive amounts of piping and plumbing run for those as well. Similar issues arise with heating and cooling systems. They too must be divided up to feed individual units. Often, entire buildings are on one centralized heating source and individual air intakes can be placed in each unit which can allow for adjusting.

Pipes and ducts can be added and moved, but things like stairwells, elevators, entrances, and exits are far more permanent and can pose serious challenges. Due to the various layouts of many commercial buildings, the feasibility of conversion can be limited. Access to and distance from design features like stairwells, elevators, entrances, and exits can be tightly regulated for safety reasons. The process of chopping up the square footage of open commercial space into neat little apartments can quickly run afoul with such regulations. Adding new stairwells, elevators, entrances, and exits can add exorbitant costs to conversion which further filters out many commercial buildings from consideration.

Let’s talk Regs!

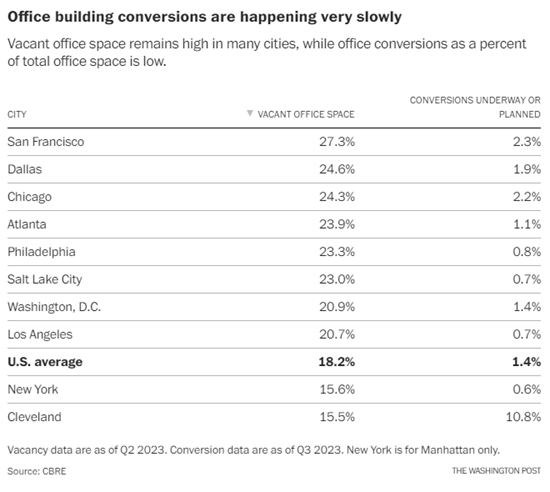

Government oversight…few roadblocks can hamper or slow office conversion progress quicker. According to the table below, conversation projects are happening at a relatively slow pace. Therefore, cities that recognize a need to convert commercial office space to residential must have programs in place to facilitate this process. There will be hundreds of seemingly minor issues that must be weighed, ruled on, and stamped with approval. If every one of those issues requires a work stoppage and weeks or months to adjudicate, then few investors in their right mind would even risk the cost of conversion.

Our reader may know that Anderson|Biro calls Cleveland, Ohio home. Thus, we are eager to point out that “The Land” is at the vanguard of the conversion process and has numerous programs set up to ease the process as doing so can help the entire city prosper. A recent study by CBRE states:

“Across 40 CBRE-tracked markets, Cleveland has the highest percentage of its office inventory planned for conversions at 11% as of 2023. This equates to 3.5 million sq. ft. planned, or in progress across 8 projects.

Approximately 57% of Cleveland conversions are office-to-multifamily projects, with multifamily accounting for 85% of conversions completed since 2016. Office-to-mixed-use conversions account for 41% and other various conversion projects account for 1%, respectively.”

“These conversions are driven by state and federal historic tax credits as well as local government incentives that make these conversions viable from a financial standpoint for developers. They help to breathe new life into Cleveland’s urban landscape, driving population gain, activating isolated pockets of the central business district, and preserving the city’s rich historic character.”

Get To the Point

The combination of record high commercial office vacancies concurrent with nationwide housing shortage suggest that it may be a no brainer as to what we as a nation should be doing with this issue. As mentioned, there are numerous challenges that must be considered and accounted for, but the process is not beyond our collective reach. Nationwide programs to streamline and accelerate the office building conversion process would serve to help investors keep above water in the commercial real estate world while simultaneously helping to relieve the massive pressure building around the residential housing shortage.

Frankly, many city centers have been hit hard over the last several decades via the great move to the suburbs and urban sprawl. The COVID-19 pandemic took another swing at many metro areas as businesses are forced to adapt to hybrid and remote models.

That said, with momentous change comes even bigger opportunity. Via conversion from commercial to residential space, America’s downtowns and dense urban centers could once again grow vibrant with bustling streets. With luck, determination, communication, and proper planning, near empty office towers could fill with apartments, shops, restaurants, and entertainment of all kind, thus leading to a renaissance of the city centers across the nation. After all, a strong city center is typically good for the entire region and it sounds like many metros are starting to adapt and overcome.

Anderson|Biro is a full-service, Executive Search firm dedicated nationally to the Financial Services sector. We source talent to service all aspects of the Built World, including the Land Title Insurance, Settlement and Appraisal industries. We have forged successful partnerships with leading Homebuilders, iBuyers, Fintech, Servicers, Law Firms, Real Estate Brokerages, Private Equity and Lenders with direct or indirect stakes around the real estate closing table. We offer quality solutions for clients in these primary fields and beyond. Our candidates are screened for specific industry experience, outstanding track records, and values that complement your mission and culture.